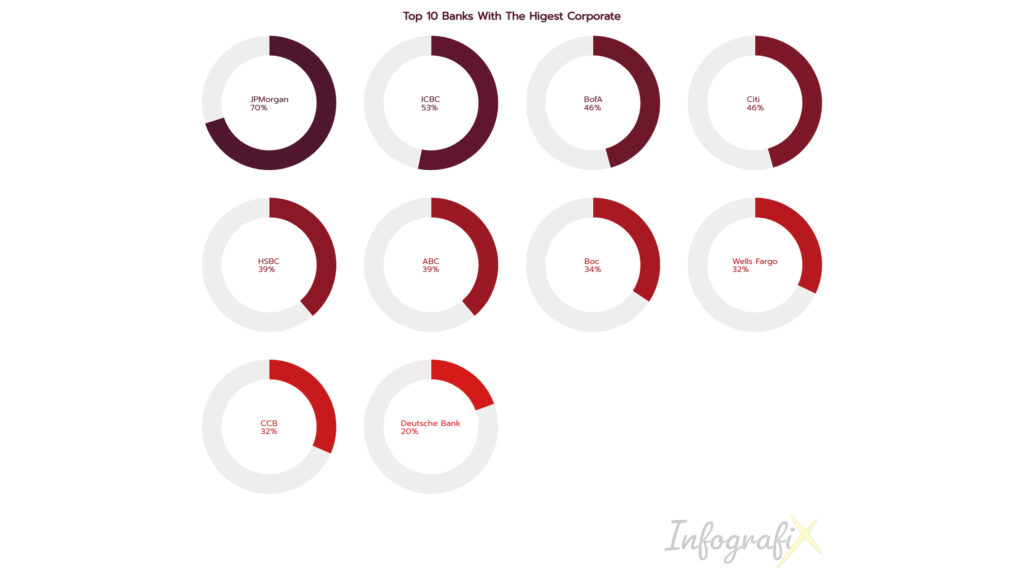

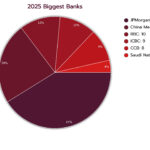

JPMorgan, the Industrial and Commercial Bank of China (ICBC), and Bank of America (BofA) topped the charts in corporate, investment, and wholesale banking revenue, highlighting a competitive landscape where banks are focusing on growth, efficiency, and innovation to reshape their leadership in the global banking sector. According to the TABInsights World’s Top 50 Corporate, Investment and Wholesale Banks Ranking 2025, these three banks reported the highest revenues in the CIW banking sector. The top 10 also features Citi, HSBC, Agricultural Bank of China (ABC), Bank of China (BoC), Wells Fargo, China Construction Bank (CCB), and Deutsche Bank.

Qatar National Bank (QNB) stands out with the highest percentage of its revenue coming from CIW banking, at 85%. First Abu Dhabi Bank (FAB) follows with 67%, while both Standard Chartered and Deutsche Bank report 60%. HSBC, Citi, and NatWest are also among the top 10 in this category.

JPMorgan, ICBC, and BofA are leading the revenue race, with JPMorgan serving clients in nearly 160 countries. The bank solidified its position in CIW banking by generating $70.1 billion in revenue from this segment in 2024. This success is attributed to its vast global network, continuous investment in technology, regulatory know-how, and strategic acquisitions. Notably, its CIW banking revenue increased by 9% in 2024, building on a compound annual growth rate (CAGR) of 3.2% from 2020 to 2023.

ICBC is closely following, with its CIW revenue projected to hit $53.2 billion in 2024, which marks a slight increase of 0.1% after a 1.8% decline in 2023. The other three major Chinese banks also reported moderate revenue growth. ABC saw a 2.7% increase in 2024, which helps to offset a 2.2% drop in 2023. BoC experienced a 5.9% decrease in CIW revenue in 2024, after a robust growth of 17.3% the year before. CCB faced an 8.4% decline in 2023, followed by an additional 4.6% drop in 2024. The bank’s modest pre-tax return on assets (ROA) of 0.6% highlights the need for improvements in its CIW banking segment.

On the other hand, BofA reported a stronger CIW revenue growth of 9.8% in 2023 and 3.3% in 2024, reaching $45.8 billion in 2024. However, it has a high cost-to-income ratio (CIR) of 56.3%, indicating that there is potential for better cost management, even with its global presence in 38 countries. Citi also experienced significant CIW growth, with its growth rate jumping from 0.2% in 2023 to 10.2% in 2024.

CIW drives revenue for QNB, FAB and key European banks

Among the top 10 banks with the highest CIW revenue, Citi had the highest CIR at 61.9%, suggesting a need for better management of operating expenses and resource utilization. In contrast, Chinese banks like CCB and ICBC, with CIRs of 39.4% and 25.7% respectively, show more efficient cost structures, benefiting from both scale and tighter cost control.

CIW is a key revenue driver for QNB, FAB, and major European banks. Half of the top 10 banks generating the largest revenue from CIW banking are European, with Standard Chartered, Deutsche Bank, and HSBC being notable players. Each of these banks derives a similar share of revenue from CIW activities, at 60%, 60%, and 59%, respectively. Their extensive range of CIW banking products gives them an edge in both product diversity and client engagement, positioning them as significant players in the global CIW banking market.

QNB and FAB, two prominent banks from the Middle East, have reported the highest shares of CIW revenue among the top 10 banks. For QNB, CIW represents a significant 85% of its revenue from domestic operations, while FAB is expected to derive 67% in 2024. Their roles as international trade hubs, combined with government initiatives to encourage digital payments and investments in technology and economic diversification, have played a crucial role in this growth. FAB has seen a CIW revenue increase of 14.8% in 2024, with a compound annual growth rate (CAGR) of 17.8% from 2020 to 2023. In contrast, American banks like JPMorgan and Bank of America generate a smaller share of their revenue from CIW, at 39.5% and 44.7%, respectively. Meanwhile, Asian banks exhibit a range of contributions to CIW revenue, with many institutions actively working to enhance their CIW portfolios and bolster their presence in this area.

Asian banks closing the gap with American giants

Asian banks are making significant progress, gradually catching up to their American counterparts. While JPMorgan and Bank of America still lead the sector, the rising influence of Chinese and other Asian banks signals a shift in the global banking landscape. As of FY2024, twelve banks worldwide had CIW banking assets surpassing $1 trillion, with ICBC, CCB, ABC, and BoC being the largest, showcasing their scale and Asia’s increasing impact on global CIW banking. ICBC, which derives 48.6% of its revenue from CIW activities, remains a key player. Although CIW revenue growth has been slow, it achieved a solid pre-tax ROA of 1.3% from these operations.

Other Asian banks are also gaining traction. A notable performer is United Overseas Bank, which has demonstrated strong growth with 47.1% of its revenue coming from CIW. The bank also achieved a robust pre-tax ROA of 1.8%, positioning itself as a rising contender that could close the gap with leading American giants. Additionally, institutions like Mizuho Bank are leveraging Japan’s significant role in global trade to enhance their positions. HSBC Hong Kong, with CIW revenue of $18.4 billion, further underscores the growing influence of Asian players.

With solid performance and strategic positioning, these banks are well-equipped to narrow the gap with American financial institutions in the years ahead. As Asia’s economic influence continues to grow and the region becomes increasingly vital to global trade, Asian banks are set to play a crucial role in shaping the future of global CIW banking.